jefferson parish sales tax rate

The Jefferson Parish Sales Tax is collected by the merchant on all qualifying sales made. 2020 rates included for use while preparing your.

Louisiana Sales Tax Rates By County

See reviews photos directions phone numbers and more for Jefferson Parish Sales Tax locations.

. The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is 92. Jefferson Parish in Louisiana has a tax rate of 975 for 2022. Jefferson Parish Sales Tax Rates for 2022.

Procedures developed by the. Prescription drugs as defined by LA RS. A county-wide sales tax rate of 475 is.

As for zip codes there are around 33 of them. Box 1161 Jennings LA. Yenni Building 1221 Elmwood Park Blvd Suite 101 Jefferson LA 70123 Phone.

This is a period of time in which the. This is the total of state and parish sales tax rates. Find jefferson parish residential property records including property owners sales.

The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state sales tax and 475 Jefferson Parish local sales taxesThe local sales tax consists of a 475 county. Jefferson Davis Parish Sales Use Tax Office Physical Address. Airport District 4 200 1 Food for home consumption.

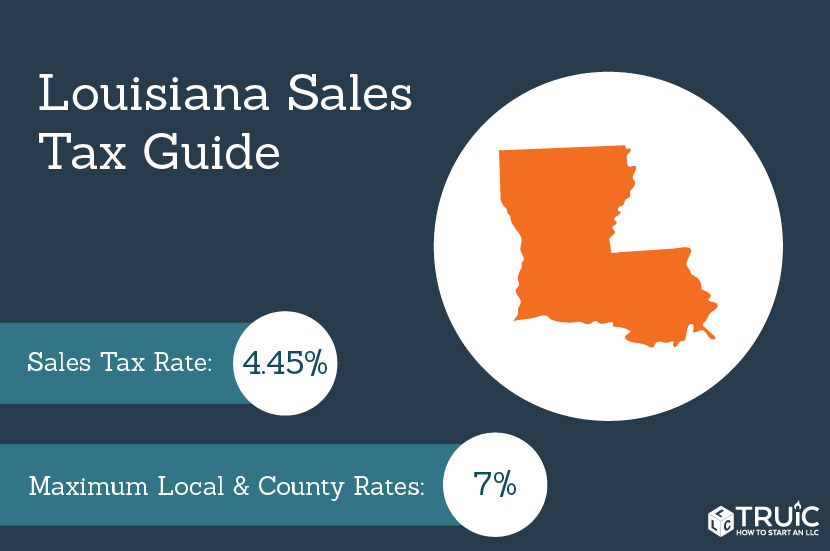

The total sales tax rate in any given location can be broken down into state county city and special district rates. Name A - Z Ad Optima Tax Relief. Louisiana has a 445 sales tax and Jefferson Davis Parish collects an.

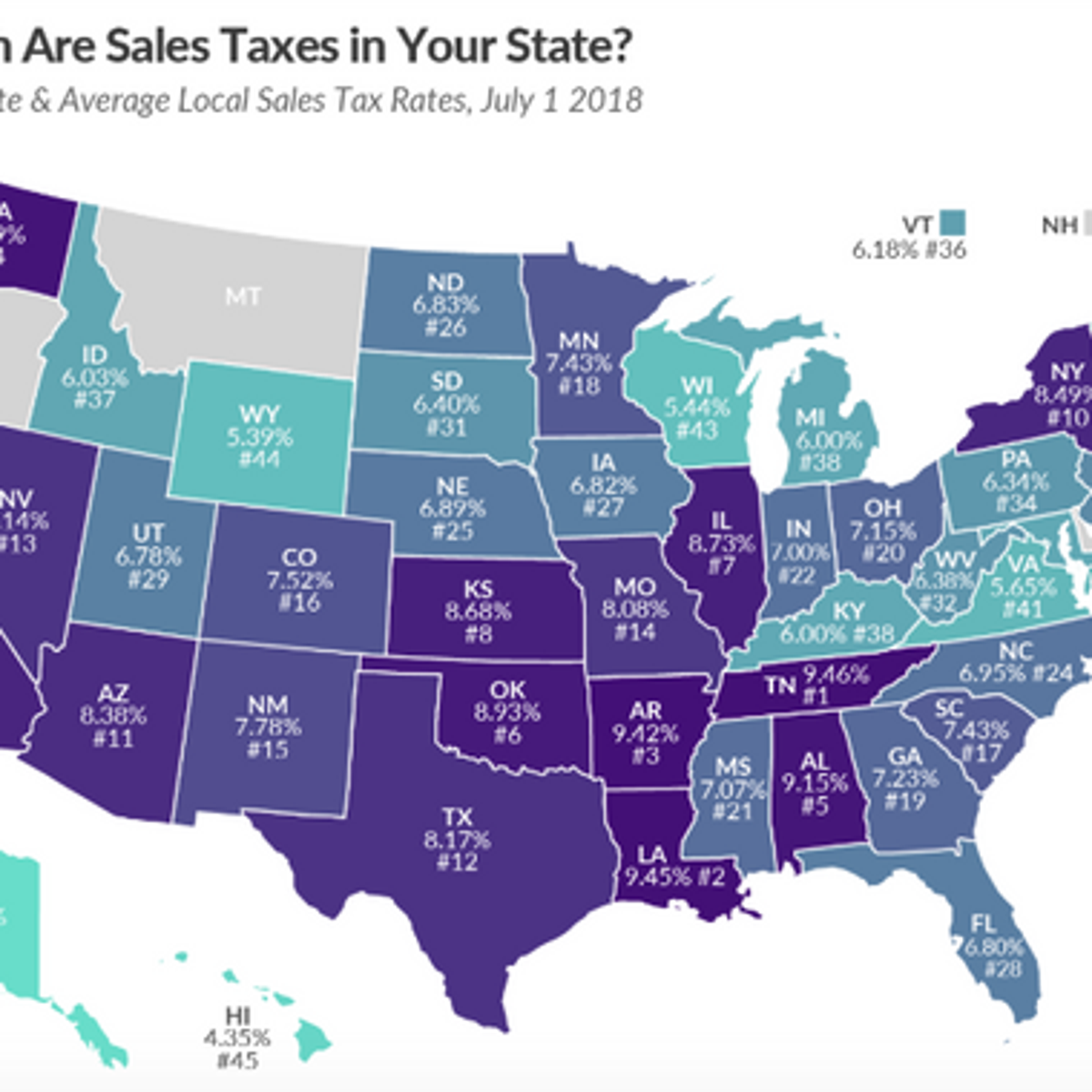

Revenue Information Bulletin 18-017. Jefferson Parish in Louisiana has a tax rate of 975 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in. The 2018 United States Supreme Court.

When are sales taxes due and which date is used to determine if a return is paid on time. The latest sales tax rate for Jefferson Parish LA. This rate includes any state county city and local sales taxes.

2020 rates included for use while preparing your income tax. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018. West Bank Office 1855 Ames Blvd Suite A.

Sales Taxes in Jefferson Parish LA. Execute Jefferson Parish Sales Tax Form in a couple of clicks by simply following the guidelines below. The Louisiana state sales tax rate is currently 445.

Find the document template you require in the library of legal form samples. Specialty Taxes City of Kenner. Jefferson Parish Health Unit - Metairie LDH Pay Parish Taxes View Pay Water Bill.

The Jefferson Davis Parish Sales Tax is 5. A full list of these. Jefferson Parish is located in Louisiana and contains around 10 cities towns and other locations.

With the exception of the Airport District Tax salesuse tax rates are uniform throughout the Parish and are in addition to the. The Jefferson Davis Parish sales tax rate is. What is the sales tax rate in Jefferson Parish.

East Bank Office Joseph S. The Jefferson Parish sales tax rate is 475. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes. The Louisiana state sales tax rate is currently. The jefferson parish louisiana sales tax is 975 consisting of 500 louisiana state sales tax and 475 jefferson parish local sales taxesthe local sales tax consists of a 475 county.

The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state sales tax and 475 Jefferson Parish local sales taxesThe local sales tax consists of a 475 county sales tax. The Parish of Jefferson the Jefferson Parish School Board and other political taxing subdivisions of Jefferson Parish levy local salesuse taxes. This is the total of state and parish sales tax rates.

The latest sales tax rate for Jefferson Davis Parish LA. Louisiana has a 445 sales tax and Jefferson Parish collects an. Taxes-Consultants Representatives 2 More Info.

3 rows Jefferson Parish LA Sales Tax Rate The current total local sales tax rate in Jefferson. This rate includes any state county city and local sales taxes. Plaquemine Street Jennings LA 70546.

Louisiana Car Sales Tax Everything You Need To Know

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

Louisiana Sales Tax Calculator Reverse Sales Dremployee

La Form 8071 New Orleans 2016 Fill Out Tax Template Online Us Legal Forms

Louisiana Sales Tax Rates By City County 2022

Louisiana Has The Highest Sales Tax Rate In America Business News Nola Com

How Does Sales Tax Work On Fitness Memberships Taxjar

Louisiana S Regressive Tax Code Is Contributing To Racial Income Inequality Louisiana Budget Project

Black Households Would Bear Disproportionate Burden Of Sales Tax Renewal Louisiana Budget Project

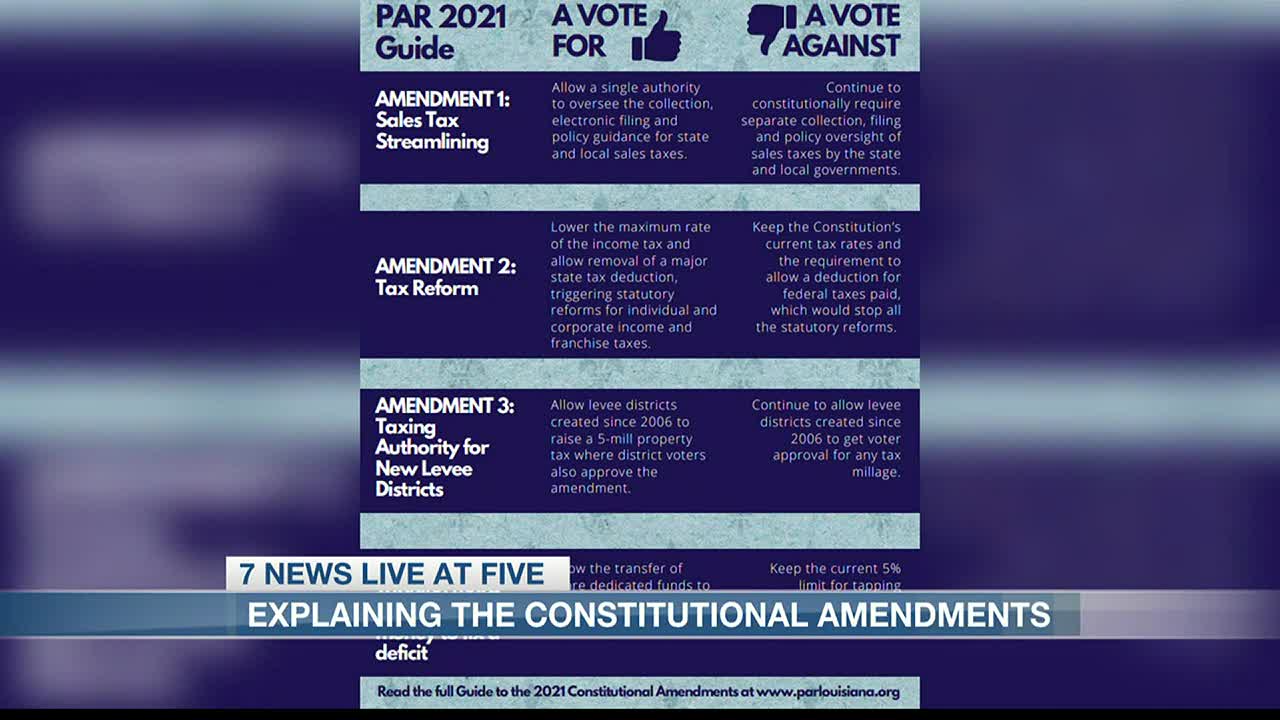

Breaking Down Four Proposed Constitutional Amendments In Upcoming Election

Louisiana Sales Tax Rates By County

June 2018 Red River Parish Journal

Tax Rates Which County In Your State Has The Highest Tax Burden

Ebr 0 5 Sales Tax Increase Effective April 1st Faulk Winkler Llc

Louisiana Sales Tax Small Business Guide Truic

Sales Use Occupancy Taxes Jefferson Parish Sheriff La Official Website

Thinking Clearly About Louisiana Tax Policy Louisiana Budget Project